The Weekender

It’s Saturday! Here’s a longer-than-normal look at an idea to fuel your facilitation business. Because when you run a business, weekends are for more than just slacking off.

Ideas and tools inside:

One simple rule to make sure you don’t run out of cash.

How to build a facilitation business budget.

Free templates for business budgeting.

Five bonus ideas.

Not budgeting will kill your facilitation business.

Here’s what happens to most business owners when they fail to budget: their business fails too. That’s because they spend more than they can afford to spend and eat up all the profits.

“Your business won’t survive without a budget. It’s that simple.”

One rule for budgeting.

Running a business is not really that complicated. As entrepreneur Marco Arment famously said, “I sell something for money, then I spend less than I make.”

I’m packing a bunch more insights into this issue, but if you follow that one rule, you’ll always have cash in your business.

You can build a budget for whatever chunks of time make the most sense for you. I’ll be assuming your budget will be monthly.

One simple rule: “I sell something for money, then I spend less than I make.”

How the pros build a small business budget.

Your budget has two parts: income on the top and expenses on the bottom. Simple enough.

You also need to be able to track along the way the amount you budgeted vs. the amount you’ve actually spent. If things go off the rails, you can call that emergency budget meeting with yourself and make some adjustments (change those client lunch meetings to coffee or walks in the park!) More on this below.

OK, now let’s do this! Here are the rules I use to build my monthly budget.

1. Sell something for money.

As a facilitator, you primarily get paid to deliver a service. Facilitating a workshop or meeting, providing one-on-one coaching, hosting trainings, etc. Maybe you also sell tangible products like workbooks, templates and guides, or graphic harvest documents. All this stuff is what brings money into your business. Duh.

How much will you sell in the next 30 days?

Step one is to estimate the amount you expect to take in this month. It’s all the cash you bring in the door. It can be based on recent numbers in your business, contracts you have lined up, or any other money you expect to come in.

In my facilitation business, I try to avoid estimating future revenue based too much on the past. Instead, I look at contracts I have already signed and proposals I feel super confident about. One thing for sure—I estimate low instead of high. Think closer to the worst case than the best case.

It’s cash only, my friend.

But don’t count revenue before you get paid. Count your cash only when you have the money in the bank—not when your proposal gets accepted and not when you’ve finished the workshop or call. The cash has to be yours—that’s when you actually have income.

2. Get real about your costs.

You need to know what you’ve been spending and what you plan to spend. Sounds simple. But getting this right can be tricky.

If you have a detailed Profit and Loss Statement (P&L) it can help a lot. If not (yet), then your bank statements can help. But that only tells you what you made int eh past and what you normally spend money on.

You’ll need to make a detailed list of any new expenses you’ve already committed to, and any purchases you know you’ll need to make in the coming 30 days for the gigs you have on the schedule (travel, supplies, printing, etc.).

My wife and I use a household budgeting app called YNAB. Here are the expense categories they suggest (adjusted a bit to apply to your facilitation business. Work your way top to bottom, because that’s the order of priority in this list.

Debt/Credit Card Payments. If you have debt, you know these are coming and you better to pay them. If you use credit cards to get all those handy points, then you know you need to pay the balance every month to avoid outrageous interest. Make a list of everything. (I also include any taxes I know are due. Taxes need to be in the highest priority expense group.)

Bills. Stuff you know you need to pay every single month and the price doesn’t change. Internet, cell phone, Miro subscription, ChatGPT Plus, accounting software, coworking space fees, etc. Again, make a list. Don’t miss any.

Frequent Expenses. These expenses aren’t as regular as monthly bills but show up most months. The cost of these usually varies too, based on how much or how often you spend on them. This is where supplies, travel, and contractor expenses show up. Luckily, facilitators usually don’t have many different kinds of frequent expenses. So write down everything you expect to pay for. And don’t forget taxes!

Non-monthly Expenses. These are the things that are not monthly expenses. They might be one-time expenses you have coming up or expenses that only show up once in a while. Maybe you need a new laptop or your easels are getting tired. Maybe you let participants use your good markers, and they’re shot. What do you know you need to buy?

Goals. Been eyeing a new bluetooth mic/speaker? Wanting to go to that expensive conference or training? This is where you stash away a bit each month. I set up a separate savings account for each of my budget goals. It’s a fun ritual at the end of the month to move money into those savings accounts. So make a list of your money goals.

3. Give every dollar a job.

Making your list is a big first step. But deciding what amount to budget for each category is the bigger deal. And the fun part. You get to be bossy with your dollars. Tell every one of those suckers exactly what to do every month.

Spend your money with confidence. You’re the boss. The drill sergeant. The maestro. When you earn money, you prioritize how you’ll use it, and then simply follow your plan.

Most of the money gurus out there go by a similar credo: give every single one of your dollars a job to do. That job is a specific item in either debt payment, bills, frequent expenses, non-monthly, or goals.

4. Spend less than you make.

This is the simplest, most important, and often most difficult rule. The bottom part of your budget needs ALWAYS to be less than the top part. You do that by keeping your overhead low.

A good life is not about living within your means, it’s about living below your means.

Spending less than you make is the only way I know to guarantee your facilitation business will never run out of cash. (Of course, that assumes you can get paid for your services and products every month. We’ll get back to that part in future issues of FoF.)

5. Track cash flow weekly.

Now you have your budget built! You are fricking awesome.

But there is no autopilot for this. You have to keep tracking how your budget compares to what you’ve actually spent—and make adjustments when something unexpected shows up (it always will).

There are many ways to do this. Apps, spreadsheets, a piece of paper (my wife always wants it on paper), whatever helps you stay on top of it. I’m giving you a list toward the end of this issue.

“A budget is telling your money where to go instead of wondering where it went.”

Typo bonus! I unintentionally sent an unedited draft to subscribers the first time I posted this. How embarrassing for me… So here is my free gift to you.

Custom Google Sheets facilitation business budget template from Vitamin F. No sign-up of any kind is required. Just please make a private copy of the sheet for yourself before plugging in your numbers.

If you are an “I have to see it” learner, this template will also help you get a better sense of the format I’ve described above. See it in action.

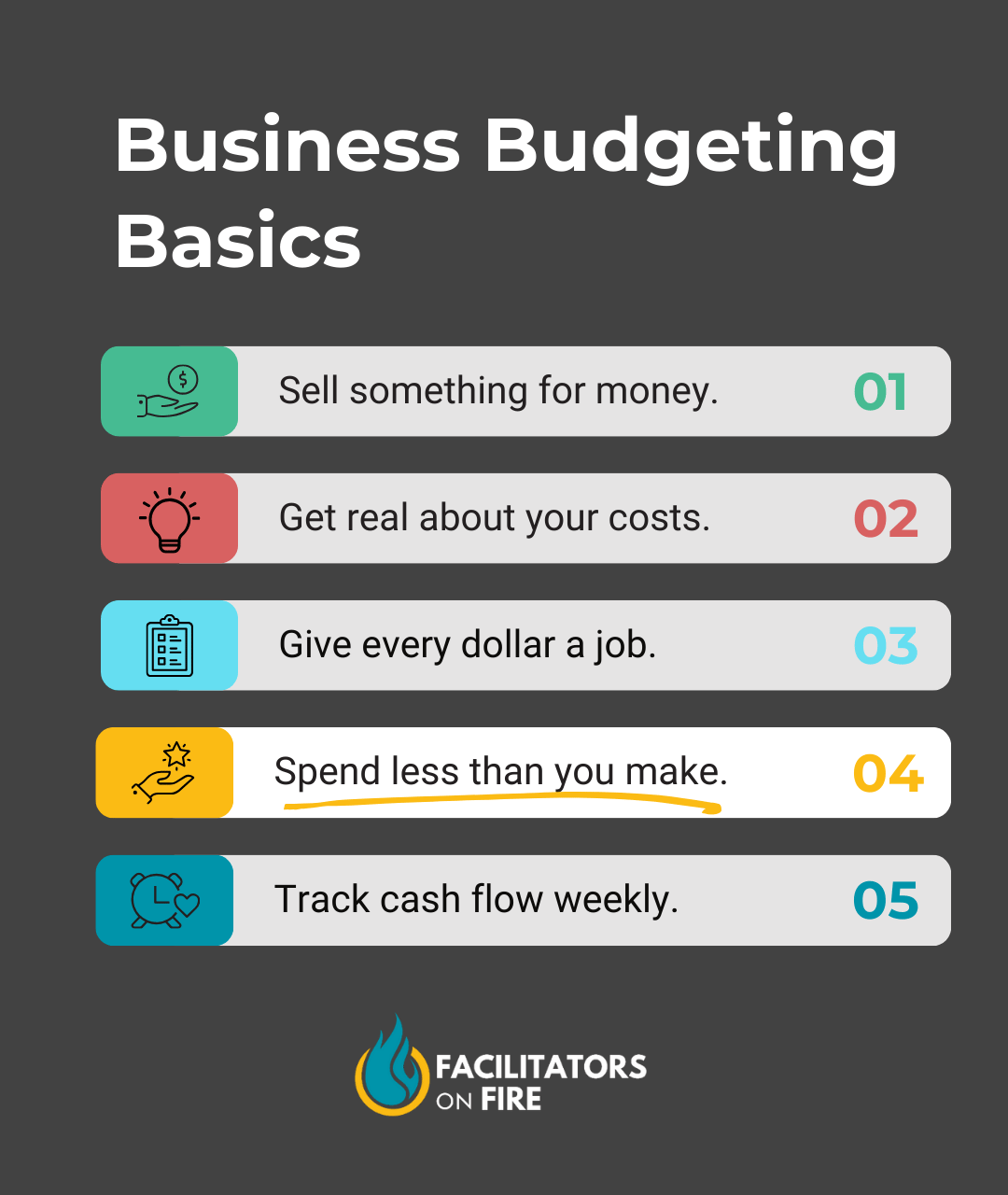

Here’s a handy 4-step reminder on the basics of building your business budget. Hint: the most important and most difficult part is #4.

Download a PDF of the basics list for free here. (No sign-up of any kind is required.)

At first you will suck at budgeting.

This is planning—and you know how strategic planning works for your clients. It’s useful but usually wrong. We cannot predict everything that will actually happen. So you probably coach your clients to check it regularly and adjust to reality.

That’s what I call a “weekly budget meeting with myself.” And once in a while, when I’ve overspent or something unexpected has messed things up, it’s an “emergency budget meeting.”

Budgeting works the same way. If you make a great plan and then don’t follow it, who cares? And if you think your plan is correct from the start, good luck.

So budgeting is predicting the future the best we can, based on the facts we know right now. But implementing your budget is way more important for your business. It requires constant outcome tracking and strategic adjustments. But most importantly, it takes discipline—building a bunch of habit energy as you learn into it.

Know another facilitator who might enjoy Vitamin F? Just forward them this email. Let’s keep building a community of entrepreneur facilitators. Thanks a bunch!

Free business budget templates

A super handy template here from Divvy. (You will need to sign up for emails to get it, though.)

Bench has tons of free money advice for your business. Scroll down a bit in this article to find the free budget templates.

Oodles of financial templates here from SCORE.

LendingTree links you to templates within some of the big spreadsheet apps like Excel and Google Sheets.

Five-bullet bonus coverage.

Don’t ever forget to set aside cash to pay taxes. Please don’t ignore this one!

A short, strait forward podcast about why you need a budget. (It’s from YNAB, with a Hat tip to Girl Boss.)

Maybe we’ve had the profit equation wrong all along?

The 50/30/20 Rule for budgeting made famous by Liz Warren.

Wake the f*ck up. Assume luck isn’t real.

Hey, I’m your host, Joe Bartmann. Get the deets on me at joebart.com.

By the way, I have no affiliation to any sources in this newsletter and don’t receive any kickbacks from their products. I just think they provide smart ideas.

If you find this newsletter helpful, could you forward it to a facilitator friend or two you know?

Facilitators on Fire is business fuel for facilitators.

I remix and share ideas and tools from experts to show you how you can help more clients and love the work you do behind your facilitation work.

Have a question or idea you want to talk with me about? Just reply to this email. It may take me a few days to get back to you, but I will!

Sources and inspiration in this issue: Austin Kleon, Bench, Ramsey Solutions (aka Dave Ramsey), Girl Boss, YNAB, James Clear/Mike Michalowicz, Khan Academy, Alex Hormozi, Venture Smarter, Divvy, SCORE. Whew, that’s a bunch. 😎